Portal:Economics

Portal maintenance status: (December 2018)

|

Economics (/ˌɛkəˈnɒmɪks, ˌiːkə-/) is a social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyses what is viewed as basic elements within economies, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and investment expenditure interact, and factors affecting it: factors of production, such as labour, capital, land, and enterprise, inflation, economic growth, and public policies that have impact on these elements. It also seeks to analyse and describe the global economy. (Full article...)

-

Image 1

Thorstein Bunde Veblen (July 30, 1857 – August 3, 1929) was an American economist and sociologist who, during his lifetime, emerged as a well-known critic of capitalism.

In his best-known book, The Theory of the Leisure Class (1899), Veblen coined the concepts of conspicuous consumption and conspicuous leisure. Veblen laid the foundation for the perspective of the institutional economics. Contemporary economists still theorize Veblen's distinction between "institutions" and "technology", known as the Veblenian dichotomy. (Full article...) -

Image 2

Gary Stanley Becker (/ˈbɛkər/; December 2, 1930 – May 3, 2014) was an American economist who received the 1992 Nobel Memorial Prize in Economic Sciences. He was a professor of economics and sociology at the University of Chicago, and was a leader of the third generation of the Chicago school of economics.

Becker was awarded the Nobel Memorial Prize in Economic Sciences in 1992 and received the United States Presidential Medal of Freedom in 2007. A 2011 survey of economics professors named Becker their favorite living economist over the age of 60, followed by Kenneth Arrow and Robert Solow. Economist Justin Wolfers called him "the most important social scientist in the past 50 years." (Full article...) -

Image 3The pluralism in economics movement is a campaign to change the teaching and research in economics towards more openness in its approaches, topics and standpoints it considers. The goal of the movement is to "reinvigorate the discipline ... [and bring] economics back into the service of society". Some have argued that economics had greater scientific pluralism in the past compared to the monist approach that is prevalent today. Pluralism encourages the inclusion of a wide variety of neoclassical and heterodox economic theories—including classical, Post-Keynesian, institutional, ecological, evolutionary, feminist, Marxist, and Austrian economics, stating that "each tradition of thought adds something unique and valuable to economic scholarship". (Full article...)

-

Image 4

Elinor Claire "Lin" Ostrom (née Awan; August 7, 1933 – June 12, 2012) was an American political scientist and political economist whose work was associated with New Institutional Economics and the resurgence of political economy. In 2009, she was awarded the Nobel Memorial Prize in Economic Sciences for her "analysis of economic governance, especially the commons", which she shared with Oliver E. Williamson; she was the first woman to win the prize.

Trained in political science at UCLA, Ostrom was a faculty member at Indiana University in Bloomington for 47 years. Beginning in the 1960s, Ostrom was involved in resource management policy and created a research center, the Workshop in Political Theory and Policy Analysis, which attracted scientists from different disciplines from around the world. Working and teaching at her center was created on the principle of a workshop, rather than a university with lectures and a strict hierarchy. Late in her career, she held an affiliation with Arizona State University. (Full article...) -

Image 5

Wilhelm Röpke

Wilhelm Röpke (10 October 1899 – 12 February 1966) was a German economist and social critic, one of the spiritual fathers of the social market economy. A professor of economics, first in Jena, then in Graz, Marburg, Istanbul, and finally Geneva, Röpke theorised and collaborated to organise the post-World War II economic re-awakening of the war-wrecked German economy, deploying a program referred to as ordoliberalism, a more conservative variant of German liberalism.

With Alfred Müller-Armack and Alexander Rüstow (sociological neoliberalism) and Walter Eucken and Franz Böhm (ordoliberalism) he elucidated the ideas, which then were introduced formally by Germany's post-World War II Minister for Economics Ludwig Erhard, operating under Konrad Adenauer's Chancellorship. Röpke and his colleagues' economic influence therefore is considered largely responsible for enabling Germany's post-World War II "economic miracle". Röpke was also a historian and was nominated to the Nobel Prize in Literature in 1965. (Full article...) -

Image 6Fisher photographed by George Grantham Bain in 1927

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.

Fisher made important contributions to utility theory and general equilibrium. He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates. His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism". Fisher was also a pioneer of econometrics, including the development of index numbers. Some concepts named after him include the Fisher equation, the Fisher hypothesis, the international Fisher effect, the Fisher separation theorem and Fisher market. (Full article...) -

Image 7

Adam Smith FRS FRSE FRSA (baptised 16 June [O.S. 5 June] 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics" or "The Father of Capitalism", he wrote two classic works, The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776). The latter, often abbreviated as The Wealth of Nations, is considered his magnum opus and the first modern work that treats economics as a comprehensive system and an academic discipline. Smith refuses to explain the distribution of wealth and power in terms of God's will and instead appeals to natural, political, social, economic, legal, environmental and technological factors and the interactions among them. Among other economic theories, the work introduced Smith's idea of absolute advantage.

Smith studied social philosophy at the University of Glasgow and at Balliol College, Oxford, where he was one of the first students to benefit from scholarships set up by fellow Scot John Snell. After graduating, he delivered a successful series of public lectures at the University of Edinburgh, leading him to collaborate with David Hume during the Scottish Enlightenment. Smith obtained a professorship at Glasgow, teaching moral philosophy and during this time, wrote and published The Theory of Moral Sentiments. In his later life, he took a tutoring position that allowed him to travel throughout Europe, where he met other intellectual leaders of his day. (Full article...) -

Image 8

Murray Newton Rothbard (/ˈrɒθbɑːrd/; March 2, 1926 – January 7, 1995) was an American economist of the Austrian School, economic historian, political theorist, and activist. Rothbard was a central figure in the 20th-century American libertarian movement, particularly its right-wing strands, and was a founder and leading theoretician of anarcho-capitalism. He wrote over twenty books on political theory, history, economics, and other subjects.

Rothbard argued that all services provided by the "monopoly system of the corporate state" could be provided more efficiently by the private sector and wrote that the state is "the organization of robbery systematized and writ large". He called fractional-reserve banking a form of fraud and opposed central banking. He categorically opposed all military, political, and economic interventionism in the affairs of other nations. (Full article...) -

Image 9Supply-side economics is a macroeconomic theory postulating that economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics theory, consumers will benefit from greater supply of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity (output per worker). Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly (e.g., over one year as opposed to 10) gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

A basis of supply-side economics is the Laffer curve, a theoretical relationship between rates of taxation and government revenue. The Laffer curve suggests that when the tax level is too high, lowering tax rates will boost government revenue through higher economic growth, though the level at which rates are deemed "too high" is disputed. A 2012 poll of leading economists found none agreed that reducing the US federal income tax rate would result in higher annual tax revenue within five years. Critics also argue that several large tax cuts in the United States over the last 40 years have not increased revenue. (Full article...) -

Image 10

Joseph Alois Schumpeter (German: [ˈʃʊmpeːtɐ]; February 8, 1883 – January 8, 1950) was an Austrian political economist. He served briefly as Finance Minister of Austria in 1919. In 1932, he emigrated to the United States to become a professor at Harvard University, where he remained until the end of his career, and in 1939 obtained American citizenship.

Schumpeter was one of the most influential economists of the early 20th century, and popularized the term "creative destruction", coined by Werner Sombart. His magnum opus is considered Capitalism, Socialism and Democracy. (Full article...) -

Image 11

Marie-Esprit-Léon Walras (French: [valʁas]; 16 December 1834 – 5 January 1910) was a French mathematical economist and Georgist. He formulated the marginal theory of value (independently of William Stanley Jevons and Carl Menger) and pioneered the development of general equilibrium theory. Walras is best known for his book Éléments d'économie politique pure, a work that has contributed greatly to the mathematization of economics through the concept of general equilibrium. The definition of the role of the entrepreneur found in it was also taken up and amplified by Joseph Schumpeter.

For Walras, exchanges only take place after a Walrasian tâtonnement (French for "trial and error"), guided by the auctioneer, has made it possible to reach market equilibrium. It was the general equilibrium obtained from a single hypothesis, rarity, that led Joseph Schumpeter to consider him "the greatest of all economists". The notion of general equilibrium was very quickly adopted by major economists such as Vilfredo Pareto, Knut Wicksell and Gustav Cassel. John Hicks and Paul Samuelson used the Walrasian contribution in the elaboration of the neoclassical synthesis. For their part, Kenneth Arrow and Gérard Debreu, from the perspective of a logician and a mathematician, determined the conditions necessary for equilibrium. (Full article...) -

Image 12

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates LLC.

First nominated to the Federal Reserve by President Ronald Reagan in August 1987, Greenspan was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position, behind only William McChesney Martin. President George W. Bush appointed Ben Bernanke as his successor.

Greenspan came to the Federal Reserve Board from a consulting career. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a "rock star". Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts. (Full article...) -

Image 13Classical economics, also known as the classical school of economics, or classical political economy, is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid 19th century. It includes both the Smithian and Ricardian schools. Its main thinkers are held to be Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. These economists produced a theory of market economies as largely self-regulating systems, governed by natural laws of production and exchange (famously captured by Adam Smith's metaphor of the invisible hand).

Adam Smith's The Wealth of Nations in 1776 is usually considered to mark the beginning of classical economics. The fundamental message in Smith's book was that the wealth of any nation was determined not by the gold in the monarch's coffers, but by its national income. This income was in turn based on the labor of its inhabitants, organized efficiently by the division of labour and the use of accumulated capital, which became one of classical economics' central concepts. (Full article...) -

Image 14In macroeconomics, chartalism is a heterodox theory of money that argues that money originated historically with states' attempts to direct economic activity rather than as a spontaneous solution to the problems with barter or as a means with which to tokenize debt, and that fiat currency has value in exchange because of sovereign power to levy taxes on economic activity payable in the currency they issue. (Full article...)

-

Image 15

Sir John Richard Hicks (8 April 1904 – 20 May 1989) was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics were his statement of consumer demand theory in microeconomics, and the IS–LM model (1937), which summarised a Keynesian view of macroeconomics. His book Value and Capital (1939) significantly extended general-equilibrium and value theory. The compensated demand function is named the Hicksian demand function in memory of him.

In 1972 he received the Nobel Memorial Prize in Economic Sciences (jointly) for his pioneering contributions to general equilibrium theory and welfare theory. (Full article...) -

Image 16Post-Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics. (Full article...)

-

Image 17

John Maynard Keynes, 1st Baron Keynes CB, FBA (/keɪnz/ KAYNZ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. He is known as the "father of macroeconomics".

During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, automatically provide full employment, as long as workers were flexible in their wage demands. He argued that aggregate demand (total spending in the economy) determined the overall level of economic activity, and that inadequate aggregate demand could lead to prolonged periods of high unemployment, and since wages and labour costs are rigid downwards the economy will not automatically rebound to full employment. Keynes advocated the use of fiscal and monetary policies to mitigate the adverse effects of economic recessions and depressions. After the 1929 crisis, Keynes also turned away from a fundamental pillar of neoclassical economics: free trade. He criticized Ricardian comparative advantage theory (the foundation of free trade), considering the theory's initial assumptions unrealistic, and became definitively protectionist. He detailed these ideas in his magnum opus, The General Theory of Employment, Interest and Money, published in early 1936. By the late 1930s, leading Western economies had begun adopting Keynes's policy recommendations. Almost all capitalist governments had done so by the end of the two decades following Keynes's death in 1946. As a leader of the British delegation, Keynes participated in the design of the international economic institutions established after the end of World War II but was overruled by the American delegation on several aspects. (Full article...) -

Image 18

Thomas Robert Malthus, after whom Malthusianism is named

Malthusianism is a theory that population growth is potentially exponential, according to the Malthusian growth model, while the growth of the food supply or other resources is linear, which eventually reduces living standards to the point of triggering a population decline. This event, called a Malthusian catastrophe (also known as a Malthusian trap, population trap, Malthusian check, Malthusian crisis, Point of Crisis, or Malthusian crunch) has been predicted to occur if population growth outpaces agricultural production, thereby causing famine or war. According to this theory, poverty and inequality will increase as the price of assets and scarce commodities goes up due to fierce competition for these dwindling resources. This increased level of poverty eventually causes depopulation by decreasing birth rates. If asset prices keep increasing, social unrest would occur, which would likely cause a major war, revolution, or a famine. Societal collapse is an extreme but possible outcome from this process. The theory posits that such a catastrophe would force the population to "correct" back to a lower, more easily sustainable level (quite rapidly, due to the potential severity and unpredictable results of the mitigating factors involved, as compared to the relatively slow time scales and well-understood processes governing unchecked growth or growth affected by preventive checks). Malthusianism has been linked to a variety of political and social movements, but almost always refers to advocates of population control.

These concepts derive from the political and economic thought of the Reverend Thomas Robert Malthus, as laid out in his 1798 writings, An Essay on the Principle of Population. Malthus suggested that while technological advances could increase a society's supply of resources, such as food, and thereby improve the standard of living, the abundance of resources would enable population growth, which would eventually bring the supply of resources for each person back to its original level. Some economists contend that since the Industrial Revolution in the early 19th century, mankind has broken out of the trap. Others argue that the continuation of extreme poverty indicates that the Malthusian trap continues to operate. Others further argue that due to lack of food availability coupled with excessive pollution, developing countries show more evidence of the trap as compared to developed countries. A similar, more modern concept, is that of human overpopulation. (Full article...) -

Image 19

John Bates Clark (January 26, 1847 – March 21, 1938) was an American neoclassical economist. He was one of the pioneers of the marginalist revolution and opponent to the Institutionalist school of economics, and spent most of his career as a professor at Columbia University. He was one of the most prominent American economists of his time. (Full article...) -

Image 20Economic democracy (sometimes called a democratic economy) is a socioeconomic philosophy that proposes to shift ownership and decision-making power from corporate shareholders and corporate managers (such as a board of directors) to a larger group of public stakeholders that includes workers, consumers, suppliers, communities and the broader public. No single definition or approach encompasses economic democracy, but most proponents claim that modern property relations externalize costs, subordinate the general well-being to private profit and deny the polity a democratic voice in economic policy decisions. In addition to these moral concerns, economic democracy makes practical claims, such as that it can compensate for capitalism's inherent effective demand gap.

Proponents of economic democracy generally argue that modern capitalism periodically results in economic crises, characterized by deficiency of effective demand; as society is unable to earn enough income to purchase its own production output. Corporate monopoly of common resources typically creates artificial scarcity, resulting in socio-economic imbalances that restrict workers from access to economic opportunity and diminish consumer purchasing power. Economic democracy has been proposed as a component of larger socioeconomic ideologies, as a stand-alone theory and as a variety of reform agendas. For example, as a means to securing full economic rights, it opens a path to full political rights, defined as including the former. Both market and non-market theories of economic democracy have been proposed. As a reform agenda, supporting theories and real-world examples can include decentralization, democratic cooperatives, public banking, fair trade and the regionalization of food production and currency. (Full article...) -

Image 21Institutional economics focuses on understanding the role of the evolutionary process and the role of institutions in shaping economic behavior. Its original focus lay in Thorstein Veblen's instinct-oriented dichotomy between technology on the one side and the "ceremonial" sphere of society on the other. Its name and core elements trace back to a 1919 American Economic Review article by Walton H. Hamilton. Institutional economics emphasizes a broader study of institutions and views markets as a result of the complex interaction of these various institutions (e.g. individuals, firms, states, social norms). The earlier tradition continues today as a leading heterodox approach to economics.

"Traditional" institutionalism rejects the reduction of institutions to simply tastes, technology, and nature (see naturalistic fallacy). Tastes, along with expectations of the future, habits, and motivations, not only determine the nature of institutions but are limited and shaped by them. If people live and work in institutions on a regular basis, it shapes their world views. Fundamentally, this traditional institutionalism (and its modern counterpart institutionalist political economy) emphasizes the legal foundations of an economy (see John R. Commons) and the evolutionary, habituated, and volitional processes by which institutions are erected and then changed (see John Dewey, Thorstein Veblen, and Daniel Bromley). Institutional economics focuses on learning, bounded rationality, and evolution (rather than assuming stable preferences, rationality and equilibrium). It was a central part of American economics in the first part of the 20th century, including such famous but diverse economists as Thorstein Veblen, Wesley Mitchell, and John R. Commons. Some institutionalists see Karl Marx as belonging to the institutionalist tradition, because he described capitalism as a historically bounded social system; other institutionalist economists[who?] disagree with Marx's definition of capitalism, instead seeing defining features such as markets, money and the private ownership of production as indeed evolving over time, but as a result of the purposive actions of individuals. (Full article...) -

Image 22

Alfred Marshall FBA (26 July 1842 – 13 July 1924) was an English economist and one of the most influential economists of his time. His book Principles of Economics (1890) was the dominant economic textbook in England for many years. It brought the ideas of supply and demand, marginal utility, and costs of production into a coherent whole. He is known as one of the founders of neoclassical economics. (Full article...) -

Image 23The American School, also known as the National System, represents three different yet related constructs in politics, policy and philosophy. The policy existed from the 1790s to the 1970s, waxing and waning in actual degrees and details of implementation. Historian Michael Lind describes it as a coherent applied economic philosophy with logical and conceptual relationships with other economic ideas.

It is the macroeconomic philosophy that dominated United States national policies from the time of the American Civil War until the mid-20th century. Closely related to mercantilism, it can be seen as contrary to classical economics. It consisted of these three core policies:- Protecting industry through selective high tariffs (especially 1861–1932) and through subsidies (especially 1932–1970).

- Government investments in infrastructure creating targeted internal improvements (especially in transportation).

- A national bank with policies that promote the growth of productive enterprises rather than speculation.

-

Image 24

Thomas Piketty (French: [tɔmɑ pikɛti]; born 7 May 1971) is a French economist who is a professor of economics at the School for Advanced Studies in the Social Sciences, associate chair at the Paris School of Economics (PSE) and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics (LSE).

Piketty's work focuses on public economics, in particular income and wealth inequality. He is the author of the best-selling book Capital in the Twenty-First Century (2013), which emphasises the themes of his work on wealth concentrations and distribution over the past 250 years. The book argues that the rate of capital return in developed countries is persistently greater than the rate of economic growth, and that this will cause wealth inequality to increase in the future. Piketty proposes improving the education systems and considers diffusion of knowledge, diffusion of skills, diffusion of idea of productivity as the main mechanism that will lead to lower inequality. In 2019, his book Capital and Ideology was published, which focuses on income inequality in various societies in history. His 2022 A Brief History of Equality is a much shorter book about wealth redistribution intended for a target audience of citizens instead of economists. (Full article...) -

Image 25

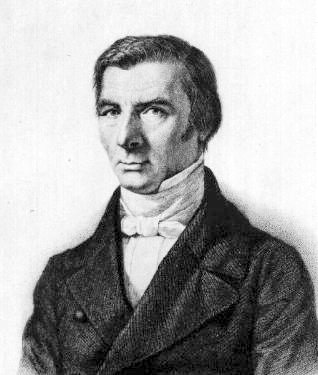

Claude-Frédéric Bastiat (/bɑːstiˈɑː/; French: [klod fʁedeʁik bastja]; 30 June 1801 – 24 December 1850) was a French economist, writer and a prominent member of the French liberal school.

A member of the French National Assembly, Bastiat developed the economic concept of opportunity cost and introduced the parable of the broken window. He was described as "the most brilliant economic journalist who ever lived" by economic theorist Joseph Schumpeter. (Full article...)

- ... that Sumitro Djojohadikusumo expected the majority of the beneficiaries of his economic policy might turn out to be "parasites"?

- ... that the selection of Palu as capital of Palu Regency led to protests from the nearby town of Donggala, concerned they would lose out on economic development?

- ... that environmental economist V. Kerry Smith has been described as a "Renaissance Man of Economics"?

- ... that Michael Kremer's O-ring theory of economic development was inspired by his forgetting to purchase toilet paper for a training session?

- ... that anti-Korean sentiment, due to South Korea's economic growth, motivated Djuna to write the sci-fi novel Counterweight?

- ... that Francois Massaquoi, who studied economics at New York University, later led the Lofa Defense Force during the First Liberian Civil War?

Do you have a question about Economics that you can't find the answer to?

Consider asking it at the Wikipedia reference desk.

For editor resources and to collaborate with other editors on improving Wikipedia's Economics-related articles, see WikiProject Economics.

-

Image 2The Marxist critique of political economy comes from the work of German philosopher Karl Marx.

-

Image 3The publication of Adam Smith's The Wealth of Nations in 1776 is considered to be the first formalisation of economic thought.

-

Image 6São Paulo Stock Exchange in Brazil, an electronic trading network that brings together buyers and sellers through an electronic trading platform

-

Image 7Pollution can be a simple example of market failure; if costs of production are not borne by producers but are by the environment, accident victims or others, then prices are distorted.

-

Image 9Economists study trade, production, and consumption decisions, including those that occur in a traditional marketplace

-

Image 10A 1638 painting of a French seaport during the heyday of mercantilism

-

Image 11An environmental scientist sampling water

-

Image 14The supply and demand model describes how prices vary as a result of a balance between product availability and demand. The graph depicts an increase in demand from D1 to D2 and the resulting increase in price and quantity required to reach a new equilibrium point on the supply curve (S).

- 18 December 2024 – 2024 Georgian presidential election, 2024 Georgian parliamentary election, 2024 Georgian post-election protests

- In an address to the European Parliament, Georgian President Salome Zourabichvili urges the European Union to economically and politically pressure the current Georgian government into holding new elections, claiming that recent elections represented a "new form of invasion" by Russia. (Euronews) (AP)

- 5 December 2024 – German economic crisis

- German workers' union IG Metall announces they will go on extended strikes next week leading up to a fourth round of negotiations with Volkswagen. (DW)

- 2 December 2024 – German economic crisis

- Workers of the German metalworkers' union IG Metall begin a labor strike after failed negotiations with Volkswagen following the closure of three automotive manufacturing plants. (DW)

- 26 November 2024 – 2021–present United Kingdom cost-of-living crisis

- Multinational car manufacturing company Stellantis announces that it will close its van-production factory in Luton, England, putting 1,100 jobs at risk, citing the UK's economic conditions and the government's zero-emission vehicle (ZEV) mandate as reasons for its closure. (The Guardian)

- 25 November 2024 – German economic crisis

- Germany's largest steelmaker conglomerate, ThyssenKrupp, announces plans to layoff 11,000 workers, including 5,000 in Europe, by 2030. (DW)

- 25 November 2024 –

- Nine migrants, including six children, are killed and 39 others are rescued from a shipwreck off the coast of Samos, Greece. (Al Jazeera) (The Express Tribune)

The following Wikimedia Foundation sister projects provide more on this subject:

-

Commons

Free media repository -

Wikibooks

Free textbooks and manuals -

Wikidata

Free knowledge base -

Wikinews

Free-content news -

Wikiquote

Collection of quotations -

Wikisource

Free-content library -

Wikiversity

Free learning tools -

Wiktionary

Dictionary and thesaurus